Award-winning PDF software

Form W-9 2025 Printable for New Jersey: What You Should Know

It helps determine if a taxpayer has been physically present in New Jersey over the course of a period of 3 months or longer. All Forms are now online! The U.S. State Department has provided the following instructions in a printed form for completing a W-4 and a W-4S. The forms are online and can be found by clicking the link provided. This online form includes references to the relevant part of the Taxpayer/Payee Manual, and is for nonresident aliens who have no taxable income or who are not required to file an adjusted gross income tax return. (Click here) PLEASE USE THE FOLLOWING FORM FOR ALL APPLICATIONS. Part 1: Form W-4 (click link) Part 4, Identification Number, and Certification: (click link) New York State is a tax haven with extensive banking and financial institutions. Therefore, individuals and business located either in New York, the United States or elsewhere should be aware that they may not be covered under any of the above forms. New York uses a three-tier system of income tax. One-Tier Income Tax The highest income tax rate is 13.1 percent for those individuals earning more than 9,975, or joint filers earning more than 46,325. The lowest rate is 0 percent for those individuals and joint filers earning less than 500. The income from each tier is taxed at 12.15 percent in addition to the state income tax rate. New York State has one of the highest state income tax rates in the nation. However, as in most other states, New York's tax rates are not the highest in the country; the rates from the rest of the state are often higher. New York State's income tax rates are subject to change. If you have any questions about the tax rate you will pay in New York, check with the department at the county/town level where you usually receive your income tax bill. Visit the Department of Taxation and Finance (DT) website for the most up-to-date information. New York Tax Bulletin April 2018 New York state requires you to file New York state annual tax returns. The New York State Department of Finance provides information about the tax rates, the filing deadline and the filing of returns. New York State does not have a sales tax and does not collect and remit sales tax.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form W-9 2025 Printable for New Jersey, keep away from glitches and furnish it inside a timely method:

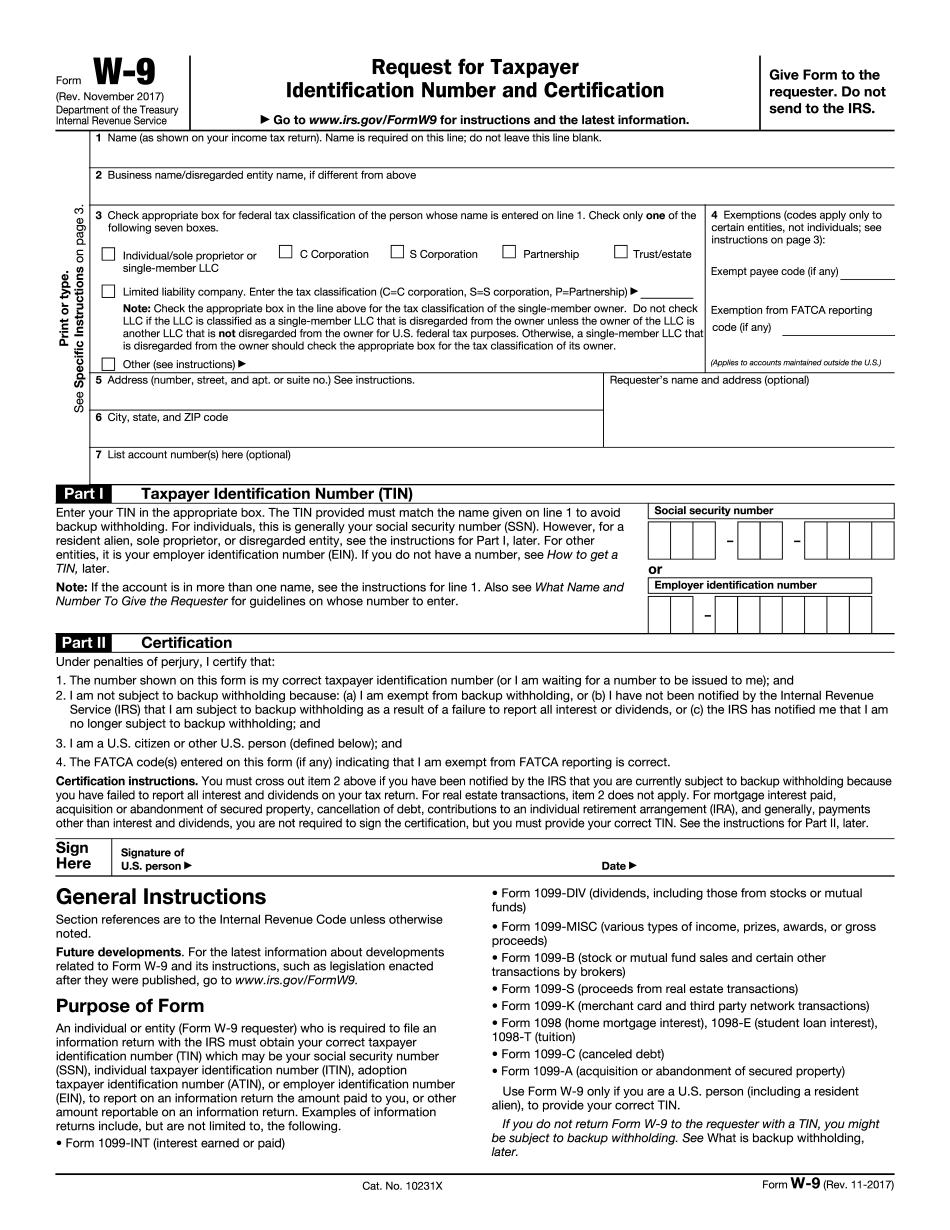

How to complete a Form W-9 2025 Printable for New Jersey?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form W-9 2025 Printable for New Jersey aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form W-9 2025 Printable for New Jersey from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.