PDF editing your way

Complete or edit your printable w 9 form 2022 irs anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export current printable w 9 form directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your irs form w 9 printable 2022 as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your blank w9 form 2022 by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form W-9 2025 Printable

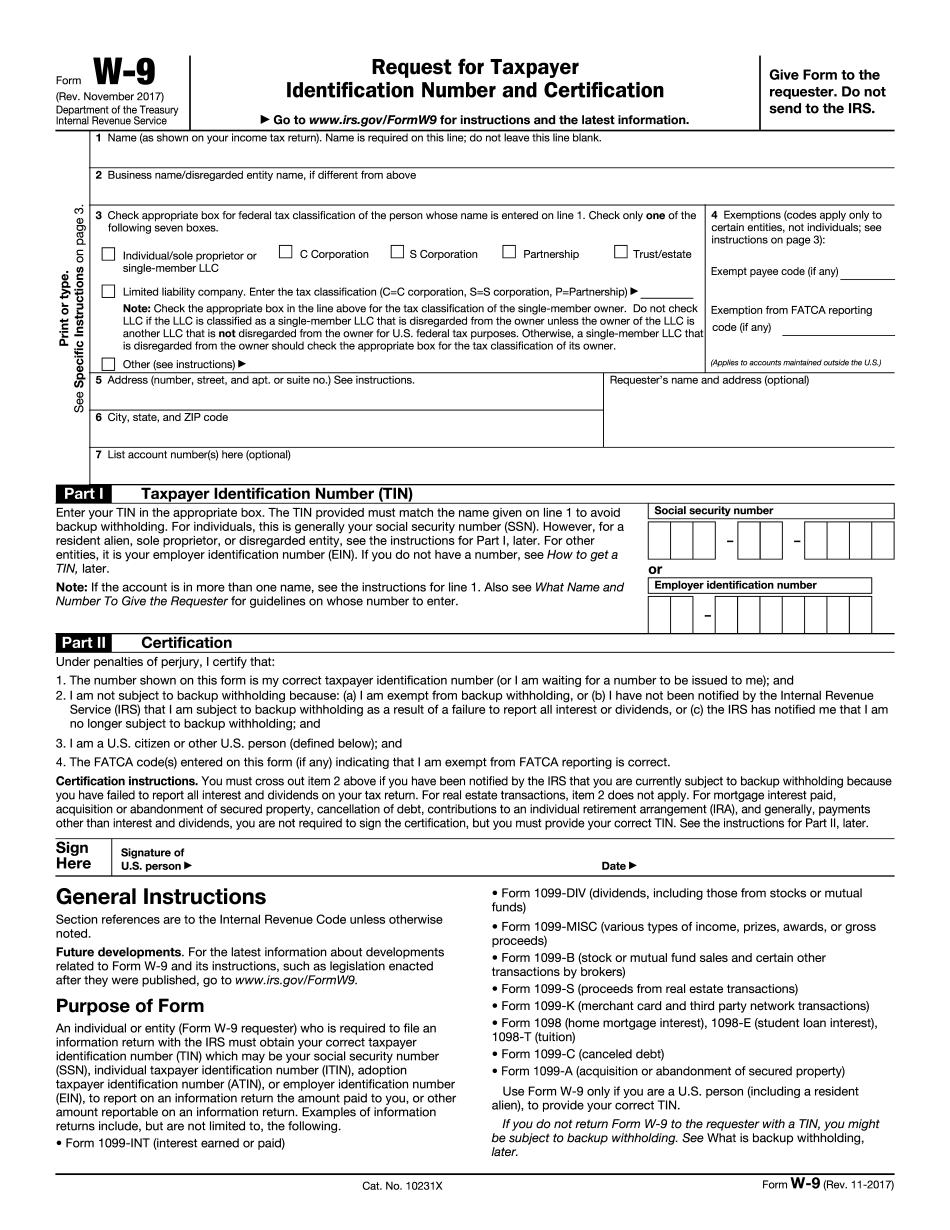

What is Form W-9

All U.S. taxpayers have an obligation to prepare declarations that contain information about the income they receive and report them to the IRS every year during the tax season. Such documents, also known as tax forms, allow the IRS to quickly and correctly process all tax-related information according to your personal details and a unique Taxpayer Identification Number (TIN).

W-9 form is one of the most significant tax returns. It applies to many cases. For instance, you might be required to fill out IRS W 9 form 2025 printable if you’re employed as a freelancer or independent contractor. Also, there are cases when you or your business prservices to another company. You might also be asked to complete the blank by your bank or another financial institution, for example when opening a checking account.

How to Fill out Form W-9 Online

A newest version of fillable W9 can be easily completed online. In order to do so, one needs to fill in the required data and sign the document electronically by typing or drawing your signature or uploading a scanned image. Then you can save it in PDF format to your hard drive. There is also a possibility to forward it to your contractor or business partner or download blank W-9 form to print it and get a paper copy.

Open the editable IRS W9 sample and read it carefully. Follow the instructions and complete the report electronically. Make sure that the following fields are properly filled in:

- Full name;

- Business name (in case it doesn’t match your full name);

- Enter your tax classification;

- Exemptions (codes applied to the entities based outside the U.S.);

- Address (also requester’s details, if necessary);

- Your city and state code;

- Indicate account numbers if necessary.

Pryour TIN, draw or type in your autograph, then click “Done”. Individuals who decided to change their name (and did not inform the SSA on time) must indicate their name as it is shown on a Social Security Card, and the new last name.

When is Backup Withholding Applied

Backup withholding only refers to specific incomes. In most cases it is applied when you make payments to business entities (such as those made to freelancers and independent contractors) you will likely have to withhold taxes from them.

Backup withholding payments include the following:

- Royalties;

- Barter transactions;

- Interest payments and dividends;

- Broker operations;

- Payment Card and Third-Party Network Transactions;

- Rents and other profits.

To obtain your TIN without any delays remember to check if the information you submit on 2025 W 9 is true and complete. Remember to sign all the papers otherwise they won't be accepted. PDF form W-9 is widely used in all kinds of employment-related transactions. Keep in mind that the form can only be filed out by U.S. citizens, U.S. resident aliens who are authorized to work in the U.S. legally and have all the necessary documents.

Online methods help you to organize your doc management and enhance the productiveness of one's workflow. Observe the quick guide to be able to finished Form W-9 2025 Printable, steer clear of errors and furnish it inside of a well timed method:

How to accomplish a Form W-9 2025 Printable on line:

- On the website together with the sort, click on Start off Now and move for the editor.

- Use the clues to fill out the suitable fields.

- Include your individual information and speak to details.

- Make certainly that you simply enter proper information and numbers in suitable fields.

- Carefully look at the content within the variety as well as grammar and spelling.

- Refer to support section for those who have any queries or address our Assistance group.

- Put an electronic signature on your Form W-9 2025 Printable with all the guide of Indicator Device.

- Once the shape is finished, push Executed.

- Distribute the prepared form via e mail or fax, print it out or help save in your machine.

PDF editor makes it possible for you to definitely make alterations to the Form W-9 2025 Printable from any online world connected unit, customize it in line with your requirements, sign it electronically and distribute in numerous strategies.