W-9 Form Printable IRS Blank 2017-2025

Show details

Hide details

Enter the name. If the owner of the disregarded entity is a foreign person the owner must complete an appropriate Form W-8 instead of a Form W-9. Foreign person. If you are a foreign person or the U.S. branch of a foreign bank that has elected to be treated as a U.S. person do not use Form W-9. See What is FATCA reporting later for further information. Note If you are a U.S. person and a requester gives you a form other than Form W-9 to request your TIN you must use the requester s form if ...

4.5 satisfied · 46 votes

w9-form-2018-printable.com is not affiliated with IRS

Filling out Form W-9 2018 Printable online

Upload your PDF form

Fill out the form and add your eSignature

Save, send, or download your PDF

A complete guide on how to Form W-9 2025 Printable

Every citizen must declare their finances in a timely manner during tax period, providing information the IRS requires as precisely as possible. If you need to Form W-9 2025 Printable, our reliable and straightforward service is here at your disposal.

Follow the instructions below to Form W-9 2025 Printable quickly and accurately:

- 01Upload our up-to-date form to the online editor - drag and drop it to the upload pane or use other methods available on our website.

- 02Read the IRSs official guidelines (if available) for your form fill-out and precisely provide all information requested in their appropriate fields.

- 03Fill out your template using the Text tool and our editors navigation to be confident youve filled in all the blanks.

- 04Mark the boxes in dropdowns using the Check, Cross, or Circle tools from the tool pane above.

- 05Make use of the Highlight option to accentuate particular details and Erase if something is not relevant any longer.

- 06Click the page arrangements key on the left to rotate or delete unnecessary document sheets.

- 07Verify your forms content with the appropriate personal and financial paperwork to make sure youve provided all details correctly.

- 08Click on the Sign tool and generate your legally-binding electronic signature by adding its image, drawing it, or typing your full name, then add the current date in its field, and click Done.

- 09Click Submit to IRS to electronically send your tax statement from our editor or select Mail by USPS to request postal document delivery.

Choose the best way to Form W-9 2025 Printable and report on your taxes online. Give it a try now!

G2 leader among PDF editors

30M+

PDF forms available in the online library

4M

PDFs edited per month

53%

of documents created from templates

36K

tax forms sent over a single tax season

Read what our users are saying

Learn why millions of people choose our service for editing their personal and business documents.

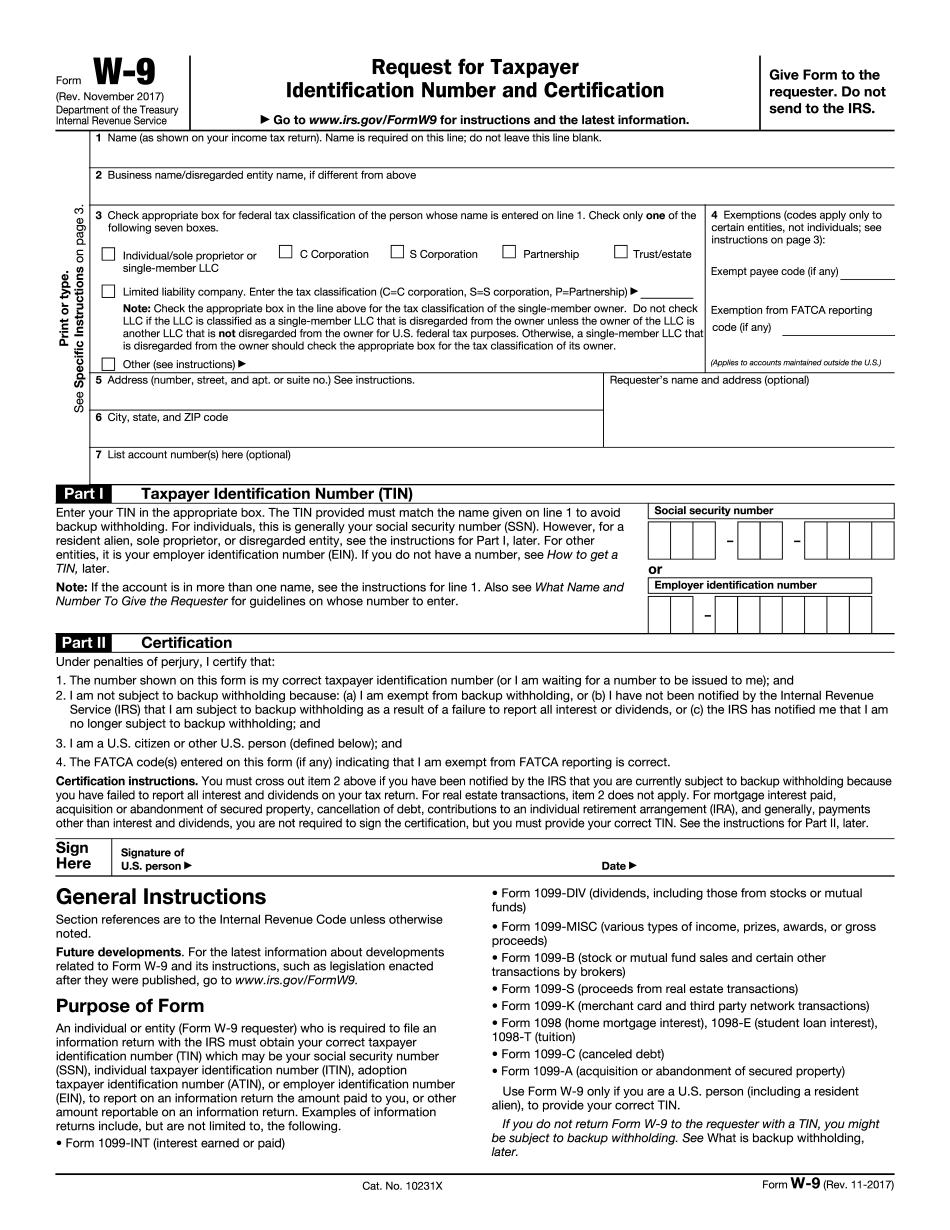

What is Form W-9

All U.S. taxpayers have an obligation to prepare declarations that contain information about the income they receive and report them to the IRS every year during the tax season. Such documents, also known as tax forms, allow the IRS to quickly and correctly process all tax-related information according to your personal details and a unique Taxpayer Identification Number (TIN).

W-9 form is one of the most significant tax returns. It applies to many cases. For instance, you might be required to fill out IRS W 9 form 2025 printable if youre employed as a freelancer or independent contractor. Also, there are cases when you or your business prservices to another company. You might also be asked to complete the blank by your bank or another financial institution, for example when opening a checking account.

How to Fill out Form W-9 Online

A newest version of fillable W9 can be easily completed online. In order to do so, one needs to fill in the required data and sign the document electronically by typing or drawing your signature or uploading a scanned image. Then you can save it in PDF format to your hard drive. There is also a possibility to forward it to your contractor or business partner or download blank W-9 form to print it and get a paper copy.

Open the editable IRS W9 sample and read it carefully. Follow the instructions and complete the report electronically. Make sure that the following fields are properly filled in:

- 01Full name;

- 02Business name (in case it doesnt match your full name);

- 03Enter your tax classification;

- 04Exemptions (codes applied to the entities based outside the U.S.);

- 05Address (also requesters details, if necessary);

- 06Your city and state code;

- 07Indicate account numbers if necessary.

Pryour TIN, draw or type in your autograph, then click Done. Individuals who decided to change their name (and did not inform the SSA on time) must indicate their name as it is shown on a Social Security Card, and the new last name.

When is Backup Withholding Applied

Backup withholding only refers to specific incomes. In most cases it is applied when you make payments to business entities (such as those made to freelancers and independent contractors) you will likely have to withhold taxes from them.

Backup withholding payments include the following:

- 01Royalties;

- 02Barter transactions;

- 03Interest payments and dividends;

- 04Broker operations;

- 05Payment Card and Third-Party Network Transactions;

- 06Rents and other profits.

To obtain your TIN without any delays remember to check if the information you submit on 2025 W 9 is true and complete. Remember to sign all the papers otherwise they won't be accepted. PDF form W-9 is widely used in all kinds of employment-related transactions. Keep in mind that the form can only be filed out by U.S. citizens, U.S. resident aliens who are authorized to work in the U.S. legally and have all the necessary documents.

Questions & answers

Below is a list of the most common customer questions.

If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of Form W-9 2018 Printable?

A-Z

List of Pass-Not-Pay or Invalid Documents A-Z

What is Form W-9 2018? Form W-9, Application for Nonemployee Director Authorization, is approved by the IRS for an individual. Form W-9 can be used by one or more employees and independent contractors of a public accounting firm, who want to be authorized as a nonemployee Director of a public accounting firm. The Director need not be an account manager or even the principal accountant. A Form Director Authorization will provide an individual with the authority to represent the public accounting firm on a tax or other legal matter as the firm's independent authority on the matter will not be limited by the individual's duties. The Form Director Authorization may also be used within other business entities for representation. However, a Form Director Authorization for a public accounting firms must not be a form used for other public accounting entities.

The Form W-9 is used:

on the company's audited financial statements in order to show the company has adequate financial resources and will fulfill its auditing obligations;

when filing to obtain a certificate of authority to carry out certain business operations, such as obtaining a certificate of authority to engage in public accounting or to obtain an operating license for a new business;

to obtain a certificate of authorization from the IRS regarding use of a “private trust” or a “corporation,” and to receive a certificate of authority to engage in certain business operations or to obtain an operating license when a qualified director is an active officer of the corporation; or

When an individual becomes a director of the corporation or firm.

Does form W-9 2018 apply to tax returns? A Form Director Authorization is NOT an individual's tax return and does not need to be filed with tax returns when the individual does not represent the corporation or public accounting firm in a legal matter, such as a bankruptcy, reorganization, or similar proceeding.

What is a “Director” of a Public Accounting Firm? The term “Director” refers to a private or public entity that establishes rules, regulates, or audits the performance and accounting of a public accounting firm, such as a publicly held firm, government agency, insurance company, and private limited liability company (LLC).

A public accounting firm is generally comprised of professional accountants as defined by the Securities and Exchange Commission (SEC).

Who should complete Form W-9 2018 Printable?

You should complete Form W-9 2018 with:

Your full name and legal address on a separate page for the forms.

All the names of the payees for the payees list.

Your Social Security number.

The payees you are filing.

The payees for each payee in your list, if different from those listed.

All of your payees for any payee that you have not named on Form W-9 2018 and that is not a named beneficiary.

Your date of birth on the front or back of the completed Form W-9.

There is not a limit to the amount of data entered on an actual Form W-9 or completed W-9, but you must enter all information to be complete.

You can only enter data for the mayor (or beneficiary) of one Form W-9.

This is the form that you will use to pay certain taxes to the government. You will fill in the information on this form and submit to the IRS using your online payment account. You may be responsible for withholding part of the taxes on your Form W-9 2018.

Form W-9 2018 (form 8969). This document is not completed at the time someone files a Form 1040 or Form 1040A. Instead, if you file a Form 1040 or 1040A, you must complete Form 1040EZ (form 8969). For Form 1040, click here.

For Form 1041, click here.

For Form 1042, click here.

You can submit Form W-9 2018 for any of the following reasons:

Your self-employment income and expenses are subject to the self-employment tax.

You have employees and are entitled to the federal employee's minimum wage and overtime pay.

You own or lease property and are using that property to earn income.

Furthermore, you have any other tax-exempt purpose.

Your income would be subject to a tax on capital gains.

You have a foreign financial account.

Your income from investment activity doesn't exceed the individual's foreign earned income level.

Form W-9 doesn't need to be completed for certain reasons. These include, but aren't limited to, these:

If Form W-9 is used because there's a difference between the person's social security number and the person's Social Security number.

When do I need to complete Form W-9 2018 Printable?

A. Filing the form with the IRS is only required for employees working in a retail store for more than ten (10) calendar hours per day, five days per week as paid, or performing duties in support of the operations of their retail store. B. The form should be completed as soon as the employee is hired. Filing the form with the IRS requires that the employee's employment authorization number (EIN) be printed on the Form W-9 or the number that is used by the federal government to authenticate a Form 1099 payer. For example, a Form W-11 may or may not appear on Form W-9. For your convenience, Form W-9 2018 is available for download here. Please be aware, however, that if you elect to not provide any EIN (other than the EIN that is printed on Form W-9) the form must be faxed or emailed to the EIN-Printing Department located within your business. Note: You may use the W-9 Instructions to obtain a printed or electronic EIN (other than for a retail store), subject to the restrictions noted, by contacting the Employee Benefits Security Administration (BSA) Telephone hotline at. How do I print a form I receive from the IRS that will be completed for me? A. The EIN on Form W-9 must be printed on the form if it is printed; otherwise, the form may not be completed. B. You must provide the completed form to the employee's EIN-Printing Department no later than January 31, 2018. How do I fax or email a form sent to the EIN-Printing Department? A. You must provide the completed form to the EIN-Printing Department no later than January 31, 2018. C. You must attach a paper copy of the Form W-9 to the electronic version of the form. How do I obtain an EIN? To obtain an EIN, select the option to submit a Tax Identification Number or MAIN from the EIN menu on either IRS.gov or IRS.gov Mobile. If you do not have a Tax Identification Number, or if you have forgotten your MAIN, follow the instructions below to obtain your EIN via secure means. How do I obtain a Taxpayer Identification Number (TIN)? AIR You can obtain a Taxpayer Identification Number from the TIN menu on IRS.gov.

Can I create my own Form W-9 2018 Printable?

You can use this Form. The Form is designed to be used by authorized agents for filing tax returns and claim refunds. However, other authorized users including: employers or service providers; self-employed individuals; landlords or occupants of rental properties; estate or trust administrators are not required to follow these Instructions. However, using the Form as your sole document is at your own risk. We will terminate your Authorized Use rights on March 31, 2028. This Form is also available as an Adobe Acrobat or PDF version at or, you can download the PDF form from our website at.

I believe that the Form or any information it contains is inaccurate, outdated, not current, or incomplete. Will you correct or update it? No, a Form W-9 will not be updated if the Form or any information it contains is inaccurate, outdated, not current, or incomplete. If you believe you have made a mistake, or you can verify the accuracy of the information in the form, you should contact us immediately.

I need assistance in processing my Form W9 with IRS Field Operations. What can I do? You can get more information about processing the Form or any other documents using our online form submission and assistive technology tools at:. You are also welcome to contact us in writing, by phone or in person. The person you contact must have an account to submit your request.

I need assistance in completing or using any other section of the Form. What can I do? Most Forms have multiple pages, but some pages consist of a single area of text. If you have trouble completing the form or your application cannot be completed in its entirety, contact us immediately at the telephone number or mail address listed in your request. There are several ways that we can assist you:

You can call: (toll-free in the United States and Canada)

For business tax returns: in the United States and Canada

For any other request. Or (for any other request.

What should I do with Form W-9 2018 Printable when it’s complete?

It should be formatted so that you can use it on any site.

The file should be the same width of the webpage.

It should be formatted so that its background is 1/32″ for the same background colors.

This means if the file is 300×250 pixels, you need to keep the background just for 1/32″.

The text you need to use should be about 10 times the width and only use capital letters.

How to upload the forms to your website?

We will show you how to upload the W-9 forms for most major companies. Click the image for the forms.

How to use Forms W-9 online?

It's very simple, you just enter the information. You don't need to print anything.

The form consists of 11 questions and 1 or 2 answers.

Click here to view the forms. Print the forms and make sure you fill them out.

How do I print the forms after getting them?

You need to use the forms for a couple of days before you can use them.

The forms have a time limit. You can't use them until the form has been filled out as it is filled out manually.

Some companies ask you to sign the form with a pen, but we know many people like printing it and signing it with their fingerprints.

We suggest you do the first few questions first and then sign it. You know, it's your money, don't get silly!

Once the initial forms are filled out, print the second and third forms before you print the fourth.

The fourth forms are only for the verification process.

What should I do with the Form W-9 2018 printable when it's completed?

It should be formatted so that you can use it on any site.

The file should be the same width of the webpage.

It should be formatted so that its background is 1/32″ for the same background colors.

This means if the file is 300×250 pixels, you need to keep the background just for 1/32″.

The text you need to use should be about 10 times the width and only use capital letters.

How to upload the forms to your website?

You need to use the forms for a couple of days before you can use them.

The forms have a time limit.

How do I get my Form W-9 2018 Printable?

We have a lot of Forms to choose from for you!

For a Form to print, click on the form link that best describes the Form.

What documents do I need to attach to my Form W-9 2018 Printable?

The documents you must attach to this form may include

A copy of your Form W-9

A completed Form W-9 (including any information regarding the pay period from which the W-9 was issued)

The completed and signed Form W-6

A copy of your pay stub

Your complete and signed Form W-4C

A copy of your W-4

The completed and signed Form U-2

The completed and signed Form 1098-T

You may also need the following forms:

If you receive Supplemental Security Income (SSI) you must obtain and attach the Forms SSA-1099.pdf, 1097.pdf, 1095-SS.pdf, 1022.pdf/SS, 1097-T, or W-2G.pdf, from any employee who is receiving SSI benefits. The documents you should request must contain:

The name of the SSI recipient

The pay period(s) for which the SSI benefits are being received (e.g., the date of pay from the employer or the date the SSI benefits are paid to the individual by the employer)

The SSI beneficiary's Social Security Number

A complete description of any deductions, credits, or payments from the SSI benefit

Any relevant information the SSA is asking for which requires the SSI recipient's consent (including the dates the benefits were paid, the amounts the individuals received, and the Social Security number of the beneficiary)

The name, address, and phone number of the contact person

If you are a U.S. citizen (including U.S. green card holders), you must obtain the following documents from the person who is the U.S. employer and payer of the Social Security benefit. These documents must contain the name and address of the person paying for the benefit and the date the payment(s) were made and the SSI number.

If you believe that your spouse is receiving SSI and your spouse is not the person providing the evidence that the individual is receiving SSI, you may have to obtain the same documents needed by the non-SSI individual above.

Additional Information

Additional information on obtaining Form W-2G or Forms 1098-T from the IRS is available in Publication 1271, W-2G, and Forms 1098-T.

What are the different types of Form W-9 2018 Printable?

To see the different types of Form W-9 online, you may want to download a PDF version of the form. For the convenience of everyone, we have also created an online Form W-9 printable. Download the form and click the Print (right and bottom left) link to get the printable version.

If you are a company that is unable to afford the expensive legal fees and legal fees to do the proper Form W-9 on your own, you may want to hire a professional form preparer.

How many people fill out Form W-9 2018 Printable each year?

We have a great website that generates the answers: Form W-9 2018!

It has answers for questions about the form, such as what “1099-MISC” is, and when you can use it. It also includes information on various forms you are already eligible to file, including an abbreviated version for certain government contracts and a shortened version for individuals and businesses. Furthermore, it is a good idea to use the “Quick Reference” on that website, so you don't spend time searching for anything.

For the 2018 “Annual Report for Tax Purposes,” which you will file when filing your 2018 tax return in April, you also have answers. You can use these as you plan your return, and in fact most people will do, because they will not have their tax return ready until after April 15.

To file your 2018 tax return you will need to fill out Form 8859—Annual Federal Tax Return, and pay any taxes due. It also includes answers to questions that may come up before (or during) filing.

For additional information on Forms W-8BEN and W-9, and for help finding answers on these forms and the 2018 Annual Report for Tax Purposes, see the articles below. Also, see Form 8859 and Publication 959.

How many people fill out Form W-8BEN (2017) (or Form W-9)?

We have a great website that generates the answers: Form W-8BEN 2018!

It has answers for questions like how the Forms W-8BEN (2017) and W-9 are due, and even includes information on various forms you are already eligible to file, including an abbreviated version for certain government contracts and a shortened version for individuals and businesses. Its pages give a good overview of these forms, including:

You can use the quick reference on the Form W-8BEN 2018 website, so you don't waste time searching for anything.

How many people fill out Form W-8BEN (2017)?

We have a great website that generates the answers: Form W-8BEN 2017!

It has answers for questions like how the forms are due, and even includes information on various forms you are already eligible to file. It also includes a simplified summary for businesses and individuals.

Is there a due date for Form W-9 2018 Printable?

Yes No Thank you for subscribing See our error to see the correction.

Popular Forms

If you believe that this page should be taken down, please follow our DMCA take down process here